Obtaining a loan can be a crucial step in fulfilling your financial needs — whether it’s buying a home, financing education, starting a business, or covering emergency expenses. However, the process of loan approval can sometimes be slow and frustrating. Understanding how to get your loan approved quickly can save you time, reduce stress, and improve your financial planning.

In this article, we will explore practical tips, common requirements, and strategic steps you can take to expedite your loan approval process. We will also address common questions about loan approvals to clarify doubts and help you prepare better.

Key Takeaways

- Maintain a strong credit profile to improve your approval chances and speed.

- Prepare all required documents before applying to avoid delays.

- Choose the right lender that matches your loan needs and offers quick processing.

- Keep your financial situation stable with steady income and manageable debts.

- Avoid multiple simultaneous applications to protect your credit score.

- Consider pre-approval as a way to expedite the process.

- Communicate openly and promptly with lenders throughout the application.

Understanding the Loan Approval Process

Before diving into the tips to speed up loan approval, it’s important to understand what loan approval entails.

When you apply for a loan, lenders assess your eligibility based on several factors:

- Creditworthiness: Your credit score and history.

- Income and Employment: Your ability to repay the loan.

- Debt-to-Income Ratio: The balance between your monthly debt and income.

- Collateral (if any): Assets you offer against the loan.

- Documentation: Verification of your financial status.

The lender performs these assessments to determine the risk of lending to you. The process involves paperwork verification, credit checks, and sometimes, manual reviews. If any information is missing or unclear, this can delay the approval.

How to Get Your Loan Approved Quickly: 10 Proven Tips

1. Check Your Credit Score and Report in Advance

| Step | Why It Matters |

|---|---|

| Check Credit Score | Understand your creditworthiness before applying for a loan |

| Get Credit Report | Review detailed credit history from bureaus |

| Identify Errors | Spot and dispute any inaccuracies |

| Improve Score (if needed) | Take steps to boost score before applying |

| Check Recent Activity | Ensure there are no unauthorized loans or inquiries |

Your credit score is one of the primary factors lenders consider. A higher credit score indicates lower risk, which can speed up approval.

- Obtain your credit report from credit bureaus.

- Check for errors or discrepancies and dispute any inaccuracies.

- Pay off outstanding debts to improve your score.

- Avoid applying for multiple loans at once as it can lower your score.

2. Choose the Right Loan Type and Lender

Not all loans and lenders have the same requirements or approval timelines.

- Research lenders who specialize in the type of loan you need (personal, auto, mortgage).

- Some lenders offer pre-approval or instant approval options.

- Online lenders may process applications faster than traditional banks.

3. Prepare Complete and Accurate Documentation

Loan applications require various documents such as:

- Identity proof

- Income proof (pay stubs, tax returns)

- Employment verification

- Bank statements

- Proof of address

Having these ready and submitting clear copies can prevent delays caused by back-and-forth document requests.

4. Maintain a Stable Income and Employment Status

Lenders prefer borrowers with stable and verifiable income sources.

- Avoid job changes or extended unemployment before applying.

- If self-employed, provide detailed financial statements.

5. Lower Your Debt-to-Income Ratio

Lenders assess your existing debts compared to your income.

- Pay down credit cards or other loans to improve this ratio.

- A lower debt-to-income ratio increases your chances of faster approval.

6. Apply for a Loan Amount You Can Afford

Requesting a loan amount aligned with your financial capacity signals responsible borrowing.

- Avoid asking for more than you need.

- Choose repayment terms that fit your budget.

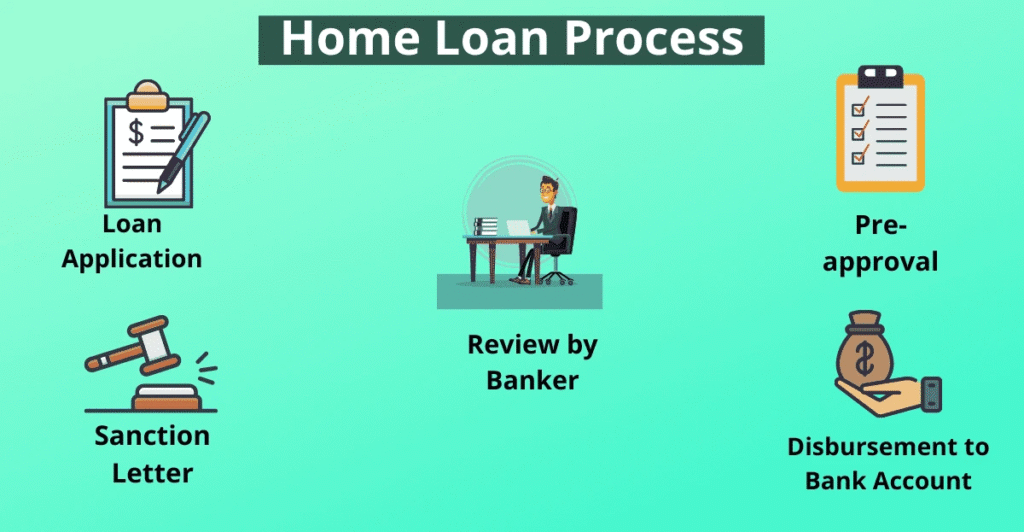

7. Get Pre-Approved Before Final Application

Many lenders offer pre-approval services that give you an estimate of how much you can borrow and your approval likelihood.

- Pre-approval is usually quicker.

- It helps identify potential issues early.

8. Avoid Multiple Loan Applications Simultaneously

Multiple applications within a short time can raise red flags for lenders and hurt your credit score.

- Focus on one lender at a time.

- If rate shopping, do it within a short window (usually 14-45 days) to minimize credit score impact.

9. Communicate Promptly and Honestly

Respond quickly to lender requests for additional information.

- Provide truthful information to avoid rejection.

- Keep contact details updated.

10. Consider a Co-Signer or Collateral

If you have poor credit or unstable income, a co-signer or collateral can speed up approval.

- Co-signers with good credit reduce lender risk.

- Collateralized loans (like home or auto loans) often have faster approval.

Common Challenges That Delay Loan Approval

Understanding what can cause delays helps you avoid pitfalls:

- Incomplete Documentation: Missing or unclear paperwork.

- Poor Credit History: Requires manual review.

- Unstable Income: Employment gaps or inconsistent earnings.

- High Debt: Excessive existing obligations.

- Verification Delays: Slow employer or bank responses.

- Complex Loans: Larger loans or special cases often take longer.

Also Read :- How Does Nelnet Manage Your Student Loan?

Conclusion

Getting your loan approved quickly is achievable with the right preparation and understanding. Start by maintaining a good credit score, organizing your documents, and choosing the appropriate lender. Be honest and responsive throughout the process, and consider strategies like pre-approval or involving a co-signer if needed.

Remember, while speed is important, ensuring your loan fits your financial situation responsibly is equally vital. Quick approval doesn’t mean you should compromise on understanding loan terms or your ability to repay.

FAQs

1. How long does it usually take to get a loan approved?

The timeline varies by loan type and lender. Personal loans can take from a few hours to a few days, while mortgages might take weeks due to more complex verification.

2. Can I get a loan approved with a low credit score?

Yes, but it depends on the lender and loan type. You may face higher interest rates or need a co-signer or collateral.

3. What documents do I need to apply for a loan?

Typically, ID proof, income proof, employment verification, bank statements, and residence proof.

4. Does applying for multiple loans affect my credit score?

Multiple applications can temporarily lower your credit score, especially if done over a longer period. Rate shopping within a short window is usually treated as one inquiry.

5. What is pre-approval and how is it different from approval?

Pre-approval is a preliminary check to estimate how much you can borrow, while final approval means your loan application has been fully accepted.

6. Can I speed up the loan approval process?

Yes, by preparing documents ahead, maintaining good credit, and responding promptly to lender requests.

7. What should I do if my loan is denied?

Ask for the reason, correct any issues, improve your credit or financial situation, and consider applying again later or with a different lender.